- Roundtables

- Sofia – February 2024

- Skopje - December 2023

- Podgorica - December 2023

- Belgrade - October 2023

- Tirana - October 2023

- Banjaluka - May 2023

- Montenegro - December 2022

- Sarajevo - December 2022

- Skopje - November 2022

- Sofia - November 2022

- Beograd - November 2022

- Tirana - September 2022

- Banja Luka - April 2022

- Skopje - December 2021

- Belgrade - November 2021

- Tirana - October 2021

- Montenegro - September 2021

- Albania - December 2020

- Skoplje - December 2020

- Beograd - December 2020

- Banja Luka - November 2020

- Podgorica - November 2020

- Podgorica - December 2019

- Prishtina - November 2019

- Belgrade - November 2019

- Banja Luka-November 2019

- Belgrade - December 2018

- Podgorica - November 2018

- Banja Luka - November 2018

- Prishtina - November 2018

- Tirana - November 2018

- Skopje - November 2018

- Zagreb - October 2018

Extended cost-benefit analysis of tobacco taxation and macroeconomic impact of tobacco taxation in Serbia

Venue: Institute of Economic Sciences, Belgrade

Date: 30.11.2022.

On Wednesday, November 30, 2022, the Institute of Economic Sciences (IES) organized a roundtable with the representatives of the Ministry of Finance of the Republic of Serbia, Tobacco Administration. The meeting was opened by an introduction on the research progress of the IES team in the realization of the project "Accelerating Progress on Effective Tobacco Tax Policies in Low and Middle-Income Countries". The IES director and Tobaccotaxation project principal investigator, Jovan Zubović, provided the opening speech.

During the meeting, the IES director and project PI presented the results of the Extended cost-benefit analysis of tobacco taxation in Serbia. The results indicated that revenues generated from tobacco excise taxes do not cover health costs and lost productivity. Moreover, by raising the specific excise tax in Serbia by 43,6%, the poorest population would benefit from the increase in the disposable net income by up to 22.623 RSD (approx. 193€) yearly.

Some of the key recommendations for policymakers include:

- Effective implementation of tax collection on tobacco products to achieve the greatest benefits from tax reform need to be ensured.

- Effective enforcement of regulations to reduce the illegal cut tobacco market is key to increasing excise duty.

- Programs to raise awareness about the health risks and costs of using tobacco products must be promoted.

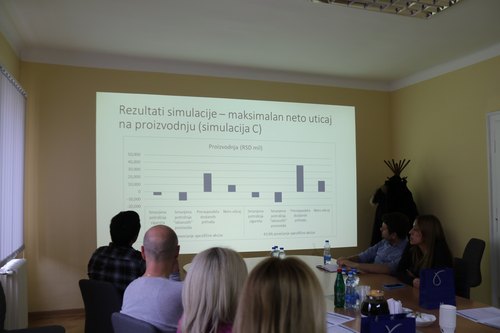

The results of research on the macroeconomic impact of tobacco taxation in Serbia were presented by a project researcher, Aleksandar Zdravković. Research evidence proved that reallocating resources from the tobacco industry to any other would positively impact employment, health, and education in Serbia. The state's legal obligation to spend a certain amount of excise revenue on socially desirable outcomes would not only be beneficial from a macroeconomic standpoint. Still, it would also increase taxpayer support for higher taxation of tobacco products, including smokers.

The presentations were followed by a fruitful discussion that pointed to the need for further collaboration of science and policymakers in creating effective tobacco taxation and tobacco control policies in Serbia.